Longevity Planning

Most people have a life insurance policy that would cover their family’s needs in the event of an untimely death. However, most do not plan for an extended life. And, those who do plan don’t always plan well enough for a full long life, where some help may be required in later years. In too many cases they are ill-prepared and shocked at the expense associated with receiving home health care – which is what most prefer. There are affordable solutions to help handle the enormous costs, but most are unaware until it is too late. Sadly, when they do realize help may be available they may not qualify due to health issues or age. There are now many affordable options available if one takes the needed action in advance.

This type of longevity planning coverage promotes the ‘Use It’ or ‘Use It’

benefit that most traditional long term care plans do not include.

Here is one illustrated example based on a single female, Linda, age 60, who does not use tobacco.

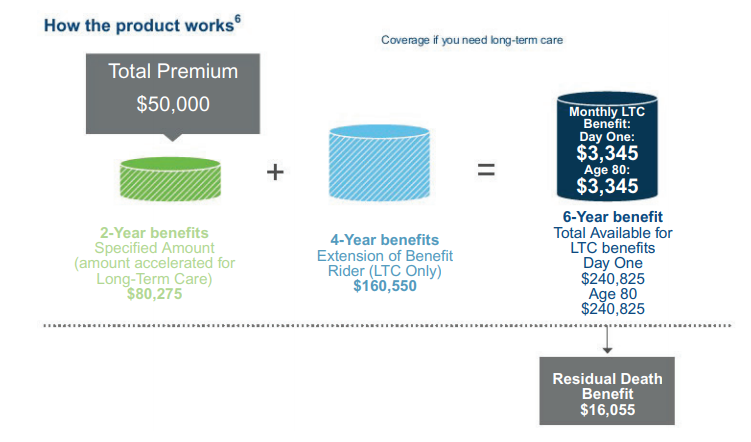

She selects the plan where she contributes a single premium of $50,000.

This illustrates that Linda would have $3345 per month of Long Term Care coverage for up to a six-year period. Also, if Linda never needs to use the Long Term Care coverage, her beneficiaries would receive the death benefit of $80,275. Last, if Linda uses ALL of her available Long Term Care coverage, she would still have a remaining death benefit (Residual Death Benefit) of $16,055.

** This is a hypothetical example meant to illustrate how Nationwide YourLife CareMatters II works.This is based on a female, non-tobacco user. LTC benefits can be subject to taxation, so please consult your legal or tax advisor on your specific situation. There is no guarantee that this product will cover the entire cost for LTC, as expenses vary with the needs of each individual.

Contact us for a free copy of the “Buyer’s Guide to: Long-Term Care Insurance” produced by the National Association of Insurance Commissioners or to schedule a free, no obligation appointment!